The new Inter Milan of Indonesian tycoon Erick Thohir, as revealed in the last days , will be the guarantor of itself regarding the 200million euro loans recently signed with the banks. So if under the management of Massimo Moratti the Italian entrepreneur represented the ultimate guarantee of solvency of the club, under the Indonesian tycoon Inter will have to go it alone, otherwise it will be risking the failure of the same club

The new Inter Milan of Indonesian tycoon Erick Thohir, as revealed in the last days , will be the guarantor of itself regarding the 200million euro loans recently signed with the banks. So if under the management of Massimo Moratti the Italian entrepreneur represented the ultimate guarantee of solvency of the club, under the Indonesian tycoon Inter will have to go it alone, otherwise it will be risking the failure of the same club

The Nerazzurri fans, however, may be relatively calm. Calcioefinanza.it has been able to see the whole plan of the transaction structured by Thohir with the support of Goldman Sachs and is now able to reveal all the details.

The plan prepared by the new president is not only in line with industry best practices (ie with the best techniques in use today in the financial sector), but mostly based on very conservative basis. This means that Thohir used caution in estimates of future earnings. Consequently, the plan seems to rest on solid foundations

Some observers had indeed sounded the alarm bell because Erick Thohir, instead of taking over directly as the guarantor of indebtedness of the company, decided to replace the existing lines of credit with a new loan, giving as security to creditors, not his personal wealth but 100% of a newly formed company (Inter Media and Communication) in which active, in addition to sponsorship contracts and thematic channel of the club, figure also the marekting contracts of controlled company Inter Brand

In short, the financial commitment of Thohir and its Indonesian partners in the club has so far been limited to 75 million paid in the capital increase reserved for November and 30 milion injected in May, and after the recent refinancing operation the club became the guarantor of its same debts. This had thrown a shadow on the actual ability of the Indonesian businessman revive the club.

The official documents of Inter prepared as part of the refinancing and consulted by calcioefinanza.it, however, seem to dispel these doubts. Not only because the refinancing and related corporate reorganization are in line with normal market practice, but also because, on the basis of estimates, trusted by the auditing firm Ernst & Young, on the income stream of Inter Media and Communication, the latter appears more than capable of doing to meet its future commitments with the banks. Let’s see how and why.

REFINANCING

On May 27, Unicredit has granted to the newly formed company Inter Media and Communication a loan of 200 million euro (can be increased up to 230 million), the company has largely turned to the parent FC Internazionale SpA

In detail, the company which has enjoyed the loan granted by Unicredit has in its turn lent to the parent company about 127 million, which used them to repay indebtedness outstanding with the banking syndicate formed by BPM, Banco Popolare, Unicredit, Veneto Banca MPS and MPS Leasing & Factoring. The repayment of the outstanding debt also allowed to release FC Internazionale SpA Massimo Moratti all of the obligations and commitments that he had taken with the banks. Unicredit has, however, asked for and received as a new guarantee, the pledge of the entire share capital of Inter Media and Communication. In other words, if the latter company is unable to honor its debt, the bank led by Federico Ghizzoni would be entitled to enforce the guarantee coming into possession of the shares of the company. This hypothesis, however, seems remote.

THE REORGANIZATION

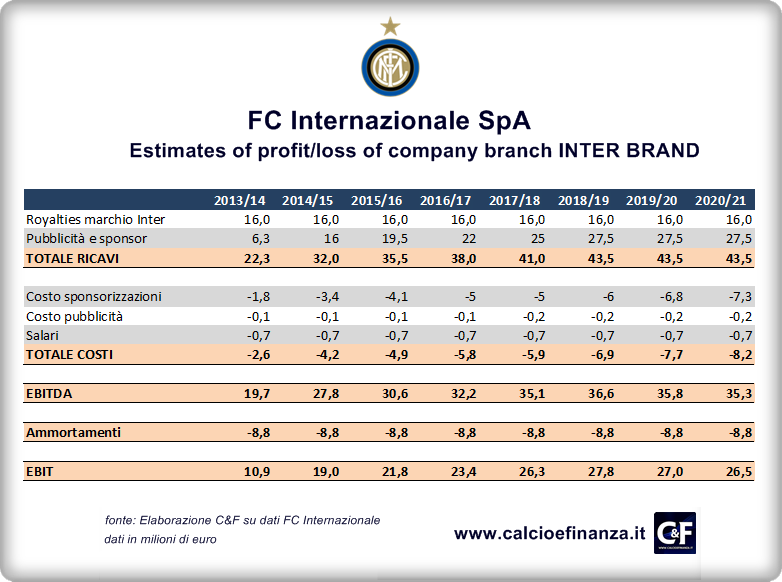

But how will Inter Media & Communication to meet its commitments with Unicredit? Until a few weeks ago the company was in fact an empty box. However, thanks to the contribution by the parent company and the subsidiary Inter Brand of the business relating to the management of sponsorships, marketing of audiovisual material historian, Inter Channel, and that inherent in the activities of licensing and merchandising as well as the brand Inter Milan, the new company has become one of the main cash generators of the group. This cash, according to predictions, however, is on an prudent basis by management of the Nerazzurri, should be sufficient to pay the annual interest of 5.5% and pay, from October 2015 until April 2019, an installment of 3 million each three months (12 million per year), which is needed to break down progressively exposure.

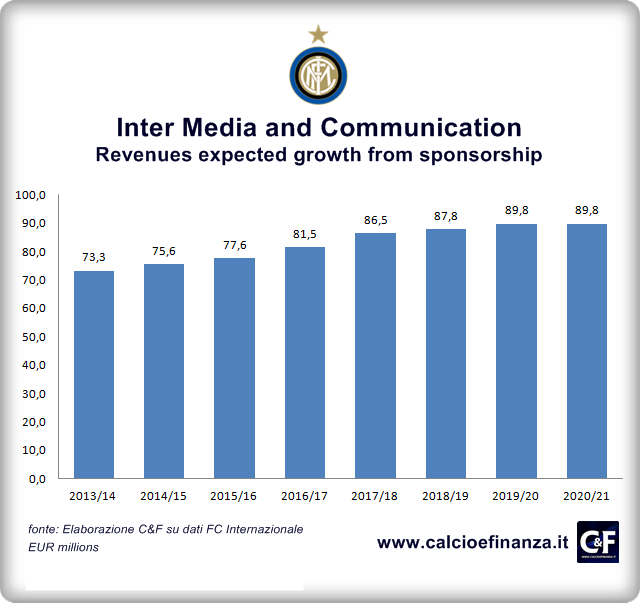

According to the estimates of Thohir and management of the Nerazzurri, in fact, the revenues of Inter Media and Communication should go from 73.3 million in the 2013/14 season (the data is pro forma, as the company is newly established) to 81.5 million in 2016/17 and then decreases to just under 90 million in 2019/20.

Taking “the first team of Inter Milan take part in the competition of the UEFA Europa League round of the Plan.”

Increase in turnover from sponsorships with Pirelli and Telecom Italy and a decrease in revenues from the agreement with Nike

An evolution of sales essentially flat to Inter Channel, and to the marketing of the contents of the archives acquired by Rai

The interruption in 2015 of child sponsorship contracts

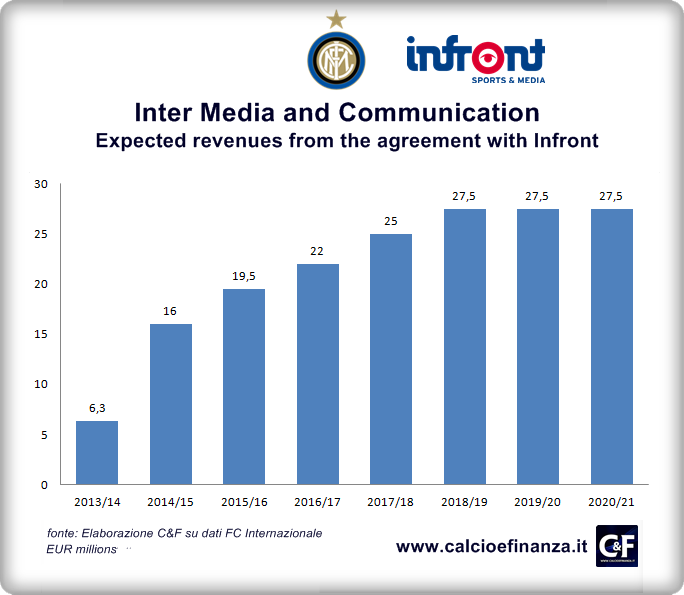

Increasing revenues of Inter Media and Communication should instead be new sponsorship agreements related all’accodo recently signed with Infront Italy